$ETHPrinter is here, and it’s ready to go brrr. Every sale feeds $ETHPrinter and is distributed directly to holders. This isn’t just another meme token—it’s your golden ticket to nonstop ETH rewards.

The Base community has been waiting for a true $ETH printer, and it’s finally here. Grab your friends, load up your wallets, and join the $ETHPrinter movement. Because when we print, we print $ETH—forever.

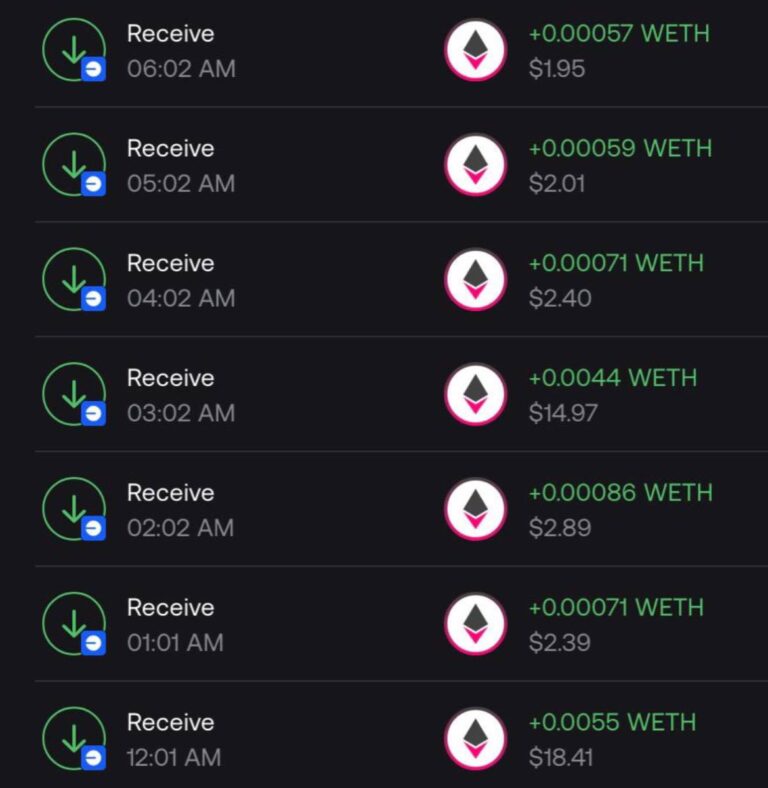

Receive wETH straight to your wallet by just holding without claiming, staking, or farming

CONTRACT ADDRESS

0x35bfE9427d37cEc78ea1EB9fa922f12Ae8A32547

Build the biggest $ETHPrinter in the world on Base to onboard the next generation of Web3 users into the Ethereum and Base ecosystems. By combining community-driven tokenomics, advanced staking strategies, and direct $ETH distributions, we aim to democratize the benefits of Ethereum’s ecosystem growth.

5% tax is for $ETH reflections

- Sales Tax: 5%

- 5% Reflections: Distributed to $ETHPrinter holders proportionally in $ETH.

- Total Supply: 1,000,000,000 tokens (1B).

- 40% Presale

- 19% Locked LP

- 5% Founders/Team

- 5% Buybacks/LP

- 6% Marketing

- 25% Treasury (validator node fund)

$ETH Reflections

Every $ETHPrinter holder receives proportional $ETH payouts directly to their wallets through a 5% sales tax mechanism.

Reserve Fund

Managed by the $ETHPrinter team, this fund grows through strategic staking, yield farming, and other $ETH-earning strategies. The long-term goal is to accumulate enough $ETH for validator nodes, enabling sustainable $ETH generation.

Validator Node Launch

The Reserve Fund's first milestone is launching its Ethereum validator node, securing the Ethereum blockchain and earning rewards for token holders.

Decentralized Governance

Upon reaching sufficient milestones, the Reserve Fund's management transitions to token holders, empowering the community to guide the project’s future.

- Launch: Deploy the $ETHPrinter token on Base.

- $ETH Reflections: Begin distributing $ETH reflections from sales tax.

- Treasury Strategies: Initiate strategies for sustainable $ETH generation

- Staking

- Deploy Stakewise Operator Service.

- Launch ETH Printer Staking Pool.

- Yield Farming & Lending: Collaborate with top DeFi protocols for optimal returns.

- Strategic Investments: Invest in promising Ethereum ecosystem projects for long-term growth.

- Key Milestone

- Goal: 10 ETH In Staking Pool

- Goal: 20 ETH In Staking Pool

- Goal: 32 ETH Full Node In Staking Pool

- Accumulate 32 $ETH in the Treasury to launch the first $ETHPrinter validator node.

- Validator Node Launch: Deploy the first $ETHPrinter validator node using 32 $ETH from the Treasury. Rewards will be distributed directly to holders.

- Governance Evolution:

- Begin transitioning Treasury governance to a Decentralized Autonomous Organization (DAO).

- Voting Options: Token holders will vote on Treasury strategies, such as:

- Building high-yield liquidity positions (e.g., Aerodrome, Alienbase, Baseswap, etc.).

- Funding validator expansions.

- Validator Expansion: Scale validator operations as the Treasury permits to enhance $ETH rewards for holders.

- Enhanced Treasury Strategies: Launch the "$ETH Forever" initiative:

- Perpetual $ETH printing through optimized Treasury management.

- Ecosystem Growth:

- Integrate $ETHPrinter with Base ecosystem dApps and projects to attract new users.

- Collaborate with top Ethereum dApps to embed $ETHPrinter benefits and drive transaction volume.

- Smart Contract Audit:

Planned Third-party audit to ensure safety and trustworthiness. - Reserve Fund Lock Mechanism:

Reserve Fund $ETH is locked in a multisig wallet, with transparent tracking accessible to the public. - Long-Term Sustainability:

A focus on generating validator rewards ensures continuous growth, independent of transaction volume.

By combining $ETH rewards, Reserve Fund growth, validator nodes, and DAO governance, $ETHPrinter offers a unique value proposition for crypto enthusiasts seeking long-term, $ETH-denominated passive income.

General Questions

What is $ETHPrinter?

$ETHPrinter is a community-driven project on the Base network that allows holders to earn $ETH passively through a 5% transaction tax on buys, sells, and transfers. This tax is distributed proportionally to all holders as $ETH reflections. In addition, the project utilizes a Treasury to grow its $ETH holdings through staking, yield farming, and validator node rewards.

How do I earn $ETH by holding $ETHPrinter?

Every buy, sell, and transfer incurs a 5% tax. This tax is collected and redistributed to all $ETHPrinter holders in the form of $ETH reflections. The more $ETHPrinter tokens you hold and the more activity in the market, the more $ETH you will receive.

Why is $ETHPrinter built on Base?

Base is a fast, secure, and low-cost Ethereum Layer-2 network that enables efficient transactions, making it ideal for projects like $ETHPrinter. By launching on Base, we aim to attract the next generation of Web3 users while staying true to Ethereum’s vision.

How sustainable is the $ETHPrinter model?

Sustainability is key to our mission. Beyond transaction taxes, we’re growing the Treasury through staking, yield farming, and validator node rewards. Our long-term goal is to achieve perpetual $ETH generation independent of trading volume.

What is the total supply of $ETHPrinter, and how is it allocated?

The total supply of $ETHPrinter is 1 billion tokens. The breakdown is as follows:

- Buy/Sell/Transfer Tax: 5%

- 5% Reflections: Distributed to $ETHPrinter holders proportionally in $ETH.

- Total Supply: 1,000,000,000 tokens (1B).

- 40% presale

- 20% to the LP (50% of the presale goes to the LP)

- 35% to the treasury

- 1% for founders (5% total)

- Softcap – 5 ETH

- Hardcap – 20 ETH

- Max Buy – .5 ETH

Security and Concerns

How much of the token supply does the team hold?

The team allocation is 5% of the total supply, distributed evenly among the founding members, capped at 1% per founder. This ensures no single team member can dominate trading fees or $ETH reflections. We’re committed to full transparency and have taken measures to avoid any centralization risks.

How is $ETHPrinter different from other tax-based tokens that failed?

Unlike projects that bundle massive team allocations or rely solely on trading activity, $ETHPrinter has a sustainable long-term plan:

- Treasury growth through staking, yield farming, and validator rewards.

- Capped team allocation (5%).

- A clear roadmap focused on decentralization and governance by the community.

Is $ETHPrinter affected by the recent GemPad incident?

No. The exploit involving GemPad affected a liquidity locker used by a few projects. $ETHPrinter remains unaffected because the vulnerability did not relate to our smart contract or token mechanics. GemPad has identified and mitigated the issue, ensuring that such incidents cannot recur.

What measures are in place to ensure liquidity safety?

To protect against rug pulls and secure liquidity for investors, our liquidity pool will be locked with GemPad. Despite the recent incident, GemPad has assured the community that the vulnerability has been fixed and all funds are safe moving forward.

Token Launch and GemPad Presale

When and where will $ETHPrinter launch?

$ETHPrinter will launch on GemPad. More details about the presale, including specific dates and how to participate, will be shared soon via our official channels.

Why did you choose GemPad for the launch?

GemPad is a trusted launchpad that offers secure presale and liquidity locking options. Although a recent incident occurred, GemPad’s team responded swiftly, fixed the issue, and provided full transparency. We are confident in their ability to provide a secure launch for $ETHPrinter.

How can I participate in the $ETHPrinter presale?

To join the presale:

- Fill out the Whitelist Form Here.

- Follow our official social channels and join our Telegram group for updates.

- Ensure you have enough $ETH on the Base network in your wallet.

- Use the official GemPad link we’ll share for a secure and transparent process.

How will the liquidity be handled post-launch?

50% of the funds raised in the presale will be added to the liquidity pool (LP). This liquidity will be locked through GemPad to ensure safety and stability.

Treasury and Validator Node Questions

What is the purpose of the Treasury?

The Treasury is a core component of $ETHPrinter’s long-term sustainability. It will grow through strategic staking, yield farming, and validator rewards. Once the Treasury accumulates 32 $ETH, it will fund the first Ethereum validator node, generating rewards that will be distributed back to $ETHPrinter holders.

What is an Ethereum validator node, and how does it benefit $ETHPrinter holders?

An Ethereum validator node helps secure the Ethereum blockchain by verifying transactions and blocks. In return, it earns $ETH rewards. $ETHPrinter’s Treasury will use these rewards to increase the $ETH payouts to all holders, creating a sustainable passive income model.

When will the first validator node be launched?

Our target is to launch the first validator node by Phase 2 after accumulating 32 $ETH in the Treasury. The node rewards will then be distributed to holders alongside transaction reflections.

Community and Governance

How can I participate in the governance of $ETHPrinter?

Once the Treasury reaches sufficient milestones, governance will transition to a Decentralized Autonomous Organization (DAO). Token holders will vote on Treasury strategies, validator node expansions, and other key decisions to guide the project’s future.

How can I stay updated and involved in the $ETHPrinter community?

- Join our official Telegram group.

- Follow us on Twitter and other social media channels.

- Participate in community discussions and governance initiatives.